Benchmarking

Overview

Comparing your company’s processes to those of your competitors is often referred to as benchmarking. All this does is compare you to others who think like your people. SatiStar’s enormous breadth of experience enables you to compare yourselves to companies “outside the box”. It is in looking at companies that are in completely different industry or service sectors that new ideas may emerge.

Benchmarking is a method for organizations to compare their processes, practices and performance with others.

There are two major approaches to benchmarking:

- Process Benchmarking

- Performance Benchmarking

Scope And Deliverables

Process Benchmarking is the comparison of practices, procedures and performance, with specially selected benchmarking partners, studying one business process at a time.

It answers the question: What is the best practice in this topic, where are the best practitioners and what can we learn from them?

Characteristics:

- Focus: a single process at a time.

- Partners: not chosen until after undertaking a thorough analysis of your own practices and performance.

- Comparison Method: whenever possible, by actually visiting the partners’ places of business.

- Confidentiality: the identity of partners is known, and the exchange of information is protected by a code of ethics.

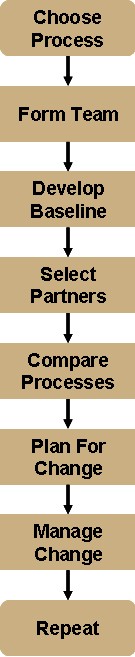

Methodology:

Methodology:

- Choose a process to study: in process benchmarking, one process at a time is studied. If you want to study more than one process, it is best to set up separate studies for each process. Examples of processes include customer service delivery, contract management, file processing, accounts payable, payroll processing – the list is endless.

- Form a team: this should include representatives of all the key stakeholders in the process being studied.

- Develop a baseline for comparison: develop an intimate knowledge of your own practices and performance. This may be via flow charts, identification of problem areas, cause-and-effect analysis etc.

- Research and select partners: your partners should be organizations that are non-competitors and not necessarily in the same industry as you. They should have some demonstrated excellence in a process analogous to the one you are studying.

- Compare processes: via site visits or detailed discussions, exchange information with your partners that allows both you and each partner to gain some new ideas about how the process is carried out, its performance results and what enables good performance.

- Plan for change: as a result of what you have learned from your partners, identify which ideas you can adopt or adapt to improve your process, and how to implement them.

- Implement new process: put the ideas in place, monitor their success and get ready to re-benchmark them at specific intervals.

Advantages:

- Allows a focus on something that will make a significant difference to organizational effectiveness.

- Allows customer focus as well as an efficiency focus.

- Enables a detailed examination of the drivers for success and efficiency.

- Change arising from process benchmarking is generally readily accepted by employees and management.

- Creates opportunities for both individual and organizational development.

Disadvantages:

- If done correctly, takes more time than you think it should

- Can use significant staff resources.

Pitfalls to Avoid:

- Rushing to compare with partners without an intimate knowledge of your own processes.

- Picking partners for convenience rather than for excellence.

- Not allowing enough time for the methodology to work properly.

- Selecting processes that do not have sufficient potential for improvement.

Outcomes:

- Effectively implement major improvements to the process that was benchmarked.

- May lead to other process benchmarking studies of other business processes.

Performance benchmarking is the collection of (generally numerical) performance information and making comparisons with other compatible organizations.

It answers the question: What are the most important performance yardsticks and where do we rank, compared with others in our industry and other analogous industries? Ideally performance benchmarking is repeated over two or three years, so that progress can be effectively monitored.

Characteristics:

- Focus: a number of performance indicators, possibly covering a range of activities in the organization.

- Partners: a number of separate organizations agree at the beginning of the project to share data.

- Comparison Method: data gathered from each partner is circulated in a report.

- Confidentiality: the identity of partners as a group is known, but each partner’s data is masked in the report by a code. Each partner knows their own code but not the codes representing the other partners.

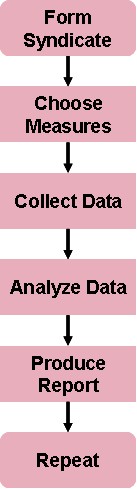

Methodology:

- Form syndicate: a group of organizations, or branches of a single organization, forms with the intention of sharing data with each other, on a strictly confidential basis. They usually choose a range of performance indicators that are of interest to all or most members of the syndicate.

- Choose measures: a SatiStar consultant works with the syndicate to develop the data structure to be used.

- Collect data: the consultant develops a data gathering template and syndicate members provide the data.

- Analyse data: the consultant analyses the raw data provided and develops ratios, percentages and other derived data so that performance indicators can be accurately compared.

- Produce report: the consultant provides a confidential report, using codes so that each syndicate member can identify their own data but is unable to attribute results to other syndicate members.

- Repeat annually: since it is most useful to monitor progress over time, the study is repeated annually at least twice.

Advantages:

- Allows a wide range of performance indicators to be studied.

- Protects confidentiality of all partners.

- Allows comparisons with competitors to be made.

- Assists in identifying priorities for improvement.

- Allows performance shortfalls to be clearly seen.

- Can use performance indicators at a variety of levels.

- Provides a cheap way of making comparisons internationally.

Disadvantages:

- Difficulties getting agreement on what indicators are to be used.

- Difficulties in defining the data.

- Gives only limited information about how to correct performance shortfalls.

Pitfalls to Avoid:

- Not spending enough time up front to get the right framework of performance indicators.

- Not defining the data items correctly and consistently.

- Not collecting the data accurately.

Outcomes:

- Performance benchmarking can lead directly to improvements, but often it is an ideal pointer to specific processes that may be improved through in-depth study using process benchmarking.

WHAT PEOPLE ARE SAYING

SatiStar's Experience Makes The Difference!